The Definitive Guide to Financial Advisors Illinois

Financial Advisors Illinois - The Facts

Table of ContentsGetting My Financial Advisors Illinois To WorkOur Financial Advisors Illinois DiariesFinancial Advisors Illinois Things To Know Before You BuyFinancial Advisors Illinois Can Be Fun For EveryoneSee This Report on Financial Advisors IllinoisGetting My Financial Advisors Illinois To Work3 Easy Facts About Financial Advisors Illinois Explained

As the graph below shows, they are most thinking about obtaining assistance getting ready for retired life and managing investments (Financial Advisors Illinois). We additionally asked if customers choose advisors who can evaluate financial investments and make profile recommendations, or are primarily curious about an advisor who establishes a plan to fulfill numerous financial objectivesThis indicates that even more customers are seeking goal-based preparation solutions than standard financial investment suggestions. We asked our participants, "Exactly how important is it that your advisor thinks about the ecological and social performance of the companies you will purchase?" The responses amazed us. Clearly, customers care concerning ESG. They additionally respect their consultants' individual values 53.8% stated an expert's individual worths affect their choice to do organization with the monetary advisor.

Our findings recommend that the majority of clients favor a balance of online and in-person services. When we asked our participants, "What is your favored type of contact with an economic expert?" we found that: 52.3% favor a preliminary in-person meeting followed by succeeding Zoom or telephone meetings 38.9% favor in-person just In regards to conference regularity, a plurality of participants really felt that every 6 months was the wonderful place although some differed.

Not known Facts About Financial Advisors Illinois

Saving for retired life in defined payment plans has created a solid desire for understanding of retired life earnings planning. Financiers want their consultant to consider their ESG choices when developing an investment approach. Extra consumers choose to participate in normal meetings with their advisor either with Zoom or a telephone call, but a strong majority still prefers to be literally present for first conferences with a consultant.

This might recommend that younger financiers are vulnerable to overconfidence. Download the 2022 Granum Facility for Financial Protection Customer Study results right here.

They discover not simply the fundamentals of how, however likewise how to have the conversations on the possible troubles or concerns that a client will encounter., examination. Financial Advisors Illinois.

4 Easy Facts About Financial Advisors Illinois Explained

In enhancement to related experience and particular education and learning requirements, in order to be a recognized CFP professional, success at an hours-long CFP examination is needed., "the CFP certification evaluation is a key need for accomplishing CFP qualification.

Those with existing relevant levels would certainly require to add this extra education and learning; if you can obtain it while you're getting your degree, you will certainly save time. "If you have an audit level, as an example, prior to you sit for the CFP examination, you 'd have to go online and take a variety of extra coursework," Allen said.

CFP practitioners can be pleased to hold out this qualification. "When you're looking for occupation opportunities, the most favorable aspect of the CFP classification is the bankability," Allen stated.

"The CFP code of principles reverberates with the general public as a better fiduciary task, placing the client first," Allen stated. "If you go use at a company without it, you 'd need to pass that CFP exam and before that, take the coursework leading up to it," Allen claimed. "Which's time (the employer is) waiting before producing profits.

The Single Strategy To Use For Financial Advisors Illinois

In considering the very first, nonetheless, you must think about if you would appreciate establishing close relationships with clients which may last years. Financial experts can practically feel like part of their client's household.

If you're functioning with a customer on an ongoing basis, you experience those changes with them. An extremely actual facet of this company is the personal element. You require to recognize their needs and purposes." An occupation in individual economic planning is a blend of left and appropriate brain techniques.

"You need to have the mind of a plutocrat, and the heart of a social employee," Mann stated. Monetary modifications great and bad, large and tiny can have a massive psychological influence on your clients. They will certainly require to recognize you care about them and their future. "I would certainly worry the relevance of compassion in this occupation," Simmerman claimed.

The 7-Second Trick For Financial Advisors Illinois

"Just how did they get to where they go to, why they sought me out as a CFP expert, and (using that to try these out figure out) what can I provide for them. You have to consider yourself to be a service-minded person." Along with the different technological and analytical elements associated with education and learning and training for this profession, the supposed "soft skills" are additionally essential as a financial organizer.

With that new broadened consideration, individual monetary planners are currently required more than ever before, to help browse the method. "It's OK for individuals not to totally comprehend every little thing they require; it's too large," Erickson stated. "You require an economic organizer that recognizes the complexities of your demands and investments and retirements.

"I do not understand a person with a CFP certification who doesn't love it, that isn't passionate in what they do," Erickson stated. "It's fairly an emotional dedication. We have on-the-job experience and education.

Financial Advisors Illinois Fundamentals Explained

An individualized economic plan is about more than your assets it's concerning just how you spend your time, what you worth, and your objectives for the future. Without proactively seeking this details out, your advisor won't have the ability to create a strategy that's tailored to you and your demands. From the very start, your monetary expert ought to ask concerns concerning that you are, what you do, your present economic standing, the monetary landmarks you want to achieve, and a lot more.

Beyond merely assisting to craft an audio economic approach, asking concerns demonstrates that the individual you're speaking to will be directly spent in and care regarding you. Nevertheless, to the best monetary expert, you're greater than just the sum of your assets you're an individual with your very own unique life circumstances and desires.

When certified as an insurance representative, they might recommend insurance choices, such as life insurance policy, health insurance policy, and right here handicap insurance policy, to aid shield clients and their possessions.

Excitement About Financial Advisors Illinois

They may assist with creating wills, establishing trusts, and making sure a smooth transfer of wealth. While monetary consultants can be a useful resource in estate planning, they are not legal professionals and customers ought to constantly consult their attorneys when taking part in estate preparation. Some economic consultants can assist customers in minimizing tax obligation obligations by planning income demands, and dealing with other experts to locate ways to aid customers keep even more of their hard-earned retirement bucks.

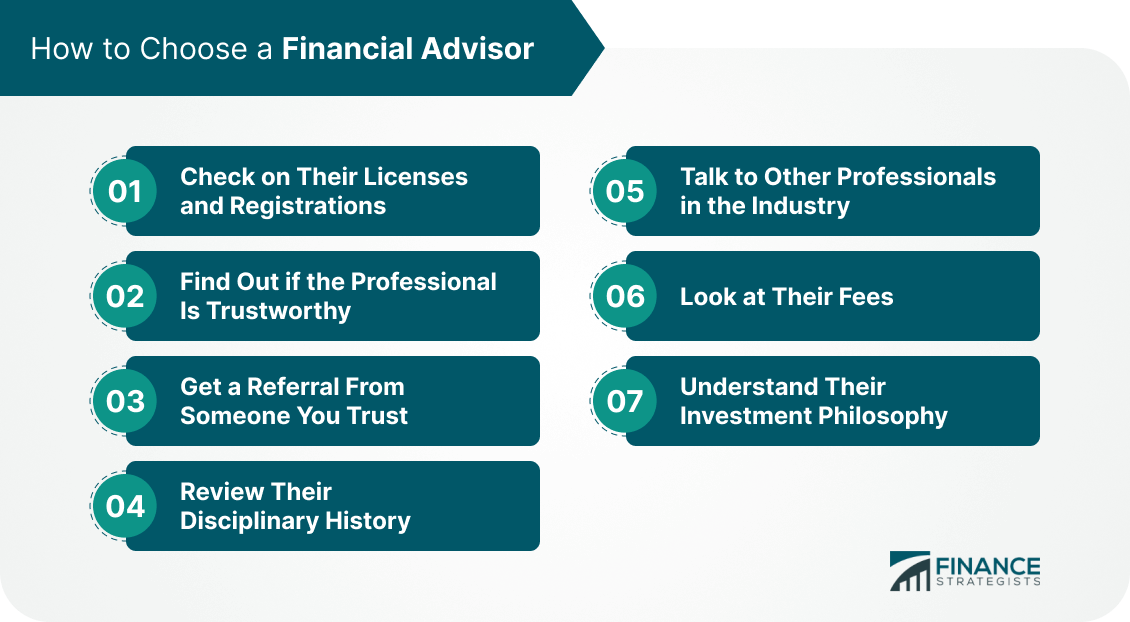

Financial advisors normally need to pass examinations related to the licenses they're going for. In addition to passing tests, consultants may require to satisfy education and learning and experience requirements.